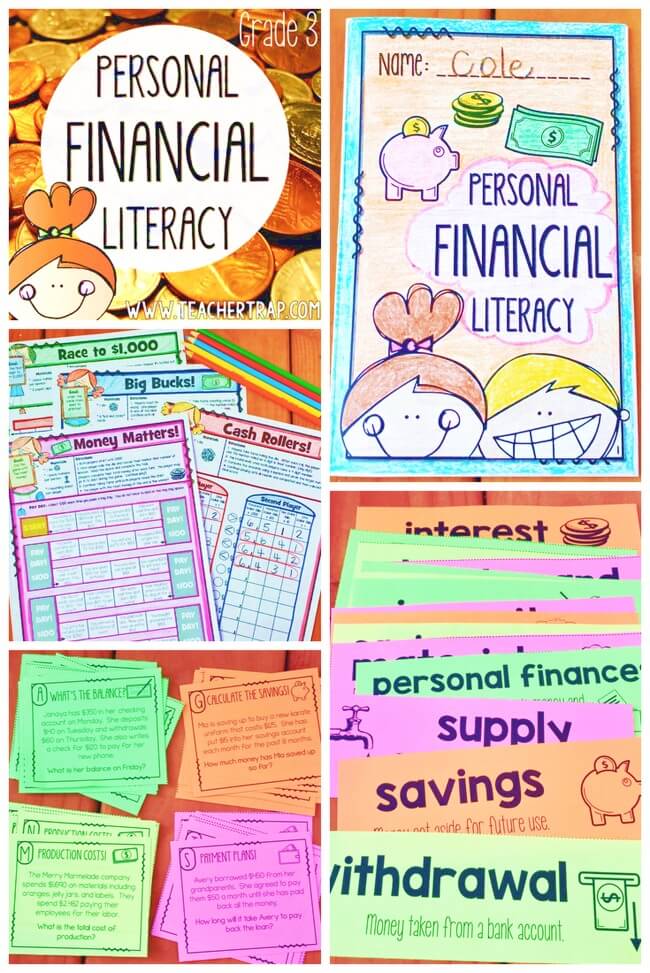

The standards around Personal Financial Literacy are complex and detailed. These five tools will make teaching the economic concepts easier for teachers and fun for kids! You’ll find ideas, books, videos, and activities to help students make sense of the standards.

TOOL #1: Personal Connections

For most young children, personal finance is a pretty foreign concept. They may not be familiar with the vocabulary or skills, BUT kids do have experiences that will help them relate. Use that background knowledge as your starting point and build from there!

For example, when teaching students about credit, start by making connections to the concept of borrowing. All kids know about borrowing! You might ask, “Have you ever had a brother, sister, or friend borrow something of yours?” Kids have tons of stories about an item borrowed and never returned or an item borrowed and returned damaged. You can also ask, “When was a time you borrowed something? Why did you borrow it? Did you return it?”

These simple conversations make it easy for students to connect the more basic form of the concept to the more sophisticated version you’ll be teaching.

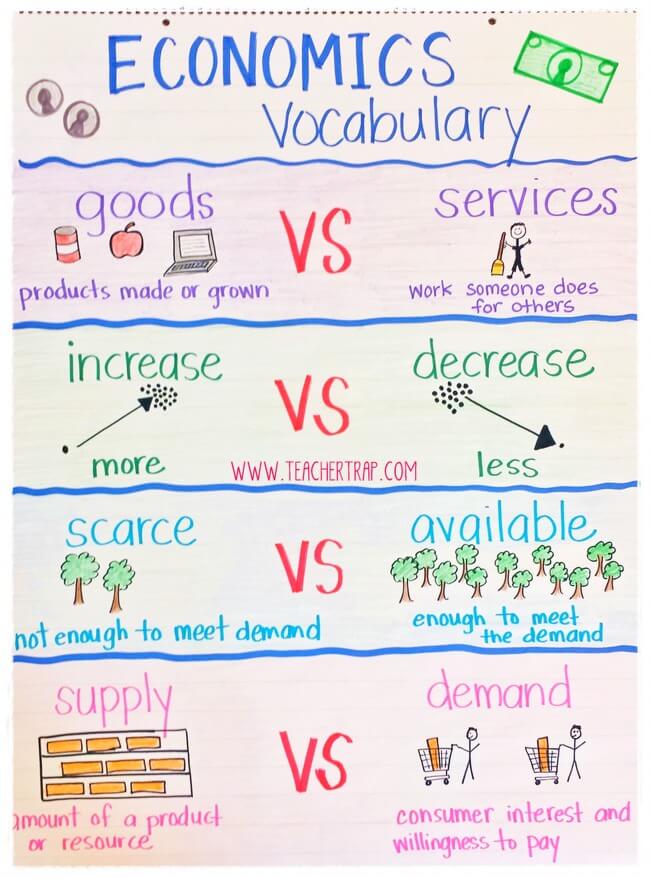

TOOL #2: Visual Representations

Creating visual representations is a proven strategy that works especially well with some of these tricky money concepts. You can provide visuals yourself or encourage students to create visuals after learning about a concept.

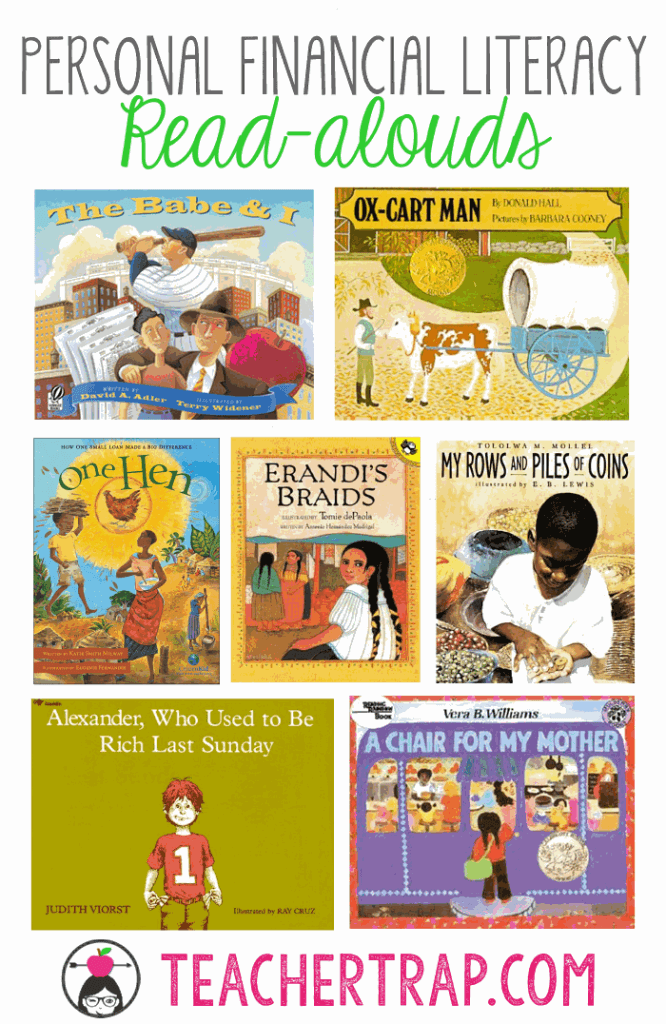

TOOL #3: Story Books

As always, the power of the story book wins again! Stories help students build background knowledge and make connections to concepts. Use a read aloud to demonstrate the different concepts related to personal financial literacy.

And if you can’t find the perfect book to illustrate the concepts, just make up your own story! Kids love hearing personal stories about their teacher. Tell about a time you had to borrow money to buy something or describe how you saved up for a big trip or purchase.

>>>This post contains affiliate links. Click here to read my Disclosure Information.

TOOL #4: Video Clips

Short videos can pack a lot of punch! Video clips are engaging to kids, bring the concept to life, and can serve as the perfect jumping off place to discuss and learn about a concept. There are some cute stories and songs that you can watch online. If you have a subscription to BrainPop, don’t forget to look there!

For example, this clip is called “A Story About Spending Wisely.”

Some other useful clips include:

Econ Vids for Kids: What is Money? (barter, surplus, trade, scarcity)

Cha-Ching: Earn, Save, Spend, Donate

TOOL #5: Drama

One of my favorite ways to help kids make sense of different financial concepts, is by using drama! We act out different scenarios so that students can actually experience the give and take of borrowing and lending or the push and pull of supply and demand.

After learning about a concept, simply craft a quick scenario and ask for a few volunteers. After students model what happened in the scene, you can “interview” the actors and audience with questions about what happened and why.

Personal Financial Literacy Pack

You can also check out my Personal Financial Literacy Pack on TPT. This pack is designed for third graders and includes lessons, activities, a student booklet, a picture book list, vocabulary cards, games, and more! I also have a pack for 2nd grade: Personal Financial Literacy Unit for Second Grade.

I’ve also been collecting ideas on a Pinterest Board.

Follow TeacherTrap’s board Personal Financial Literacy on Pinterest.

Good luck teaching our kids to be financially responsible! It’s a big task!